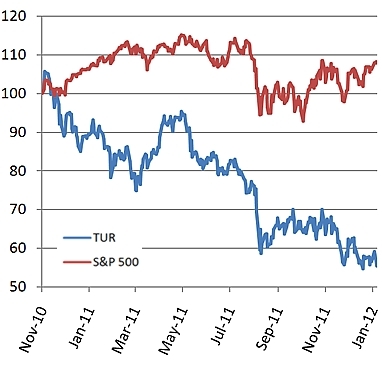

That's the thesis implicit to David Goldman's analysis at "Recall notice for the Turkish model." After dubbing the Turkish economy a bubble that "is bursting, starting with the stock market and national currency," he makes this observation about the prime minister:

Erdoğan has the weirdest economic views of any serving head of government. He justified the credit bubble on religious grounds, pledging repeatedly to cut the "real" interest rate (the cost of interest minus the inflation rate) to zero. "We aim to cut the real interest rate in the long run, so people will increase their incomes through working, not through interest," he said last April. "Eventually we aim to equalize the interest rate and inflation rate." Erdoğan believes that this would fulfill the Islamic injunction against lending for interest; if the real interest rate is zero, he seems to think, the sharia ban on interest is fulfilled de facto.

In other words, Erdoğan's wacky financial ideas, which are likely to doom his country's economy, follow directly from his Islamist dream of eliminating riba (usury). More generally put, the Islamist economic program undermines itself. (January 10, 2012)

Turkish stock market vs. S&P 500 (November 2010 = 100). Source: Bloomberg |